tax identity theft def

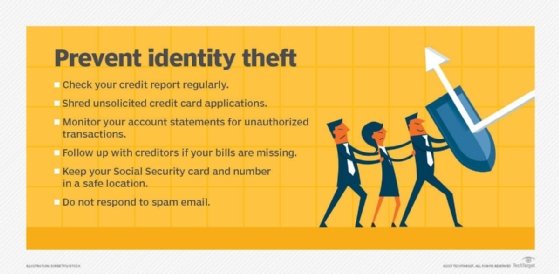

Identity theft is on the rise. Place a fraud alert on your credit file with one of the three major credit bureaus.

Identity Theft Laws In California Penal Code 530 5 Pc

Or to establish accounts using anothers name.

. To apply for loans. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. It can take up to 180 days for the process to be completed depending on how complex of.

Some fraudsters might email your employees or customers while pretending to be your business. Identity Theft is the assumption of a persons identity in order for instance to obtain credit. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund.

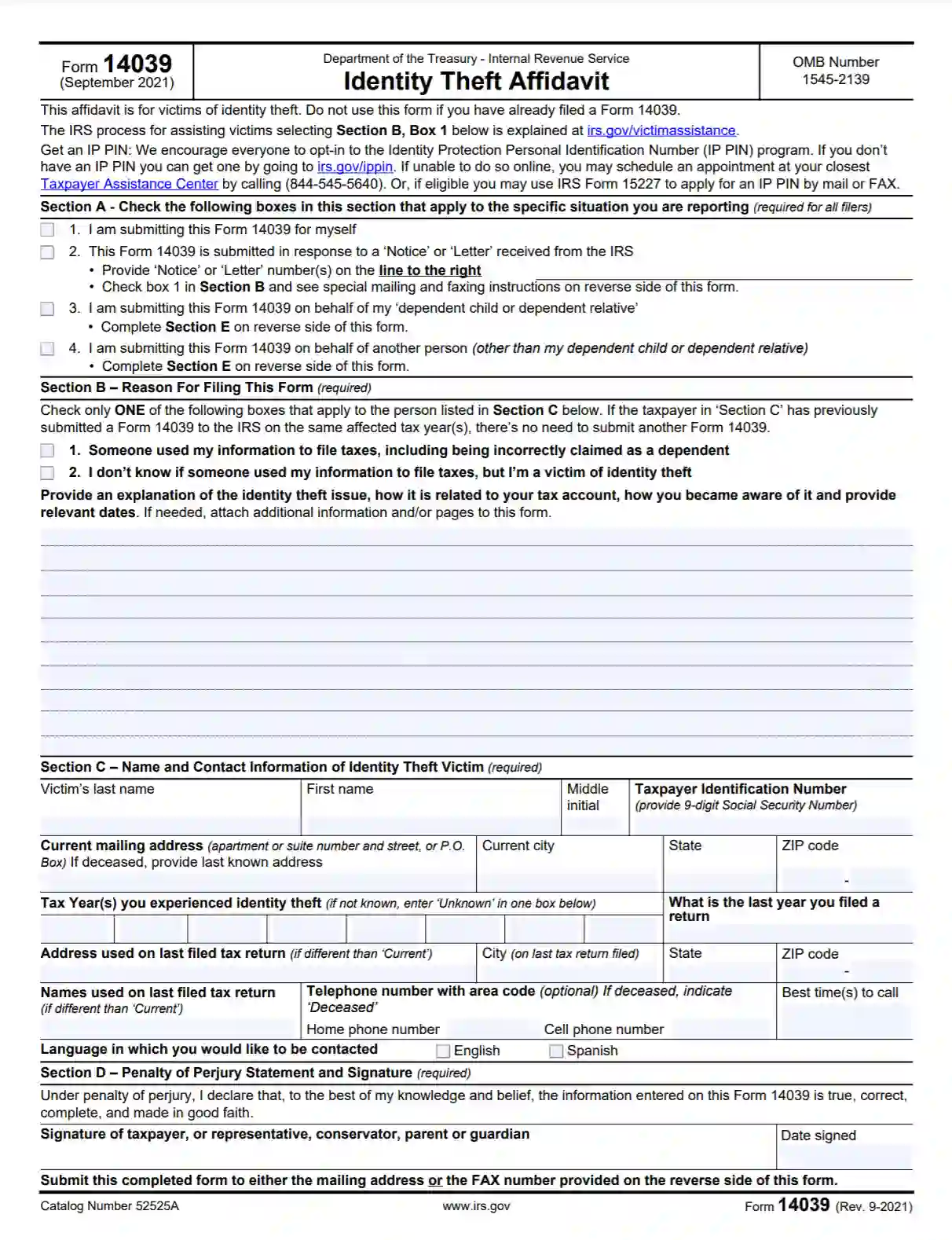

Leave us your. You can also get the Identity Theft Affidavit IRS Form 14039 from irsgov and submit it by mail. Get Alerts Credit Reports and More.

The financial losses totaled over 168 billion. Then theyd attempt to file fraudulent tax returns to. Identity theft also known as identity fraud is a crime in which an imposter obtains key pieces of personally identifiable information such as Social Security or drivers license numbers in order to impersonate someone else.

February 22 2019. And the United States as the theft of. Unlike some other forms of identity theft it can be hard to take preventative measures to avoid tax identity theft.

The IPSU is responsible for monitoring the taxpayers account but does not actually take corrective action to address the issues surrounding identity theft. This is the most common type of tax identity theft. If you believe you may be a victim you need to immediately take steps to protect your personal identity information.

Since that time the definition of identity theft has been statutorily defined throughout both the UK. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that youre entitled to one. To file a return to get your refund.

The bureau you contact must tell the other two. It takes many forms from medical and insurance to. You find out about it when you try to file a return.

More from HR Block. Tax identity thieves steal taxpayers names and Taxpayer Identification Numbers like Social Security Numbers or Individual Taxpayer Identification Numbers for one of two reasons. You Need Constant Protection.

If you try and e-file your return and it is. Check out our Identity Theft Education center for steps to mitigate identity theft and what to do in the event you become a victim. Definition of Identity Theft.

Your Digital and Financial Identity Face Constant Risks. Ad Your Protection Is Always On With Real People Ready 247 To Help When You Need It. If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you.

To obtain credit cards from banks and retailers. The email would request files of W-2 forms of some or all of your companys employees. Were victims of identity theft in 2017 an 8 increase from the previous year.

IdentityTheftgov will create your. There are a number of tactics identity thieves use to profit off your small business. Noun The act of fraudulently obtaining and using another persons identifying information or personal financial documents such as a credit card or bank account usually for the purpose of financial gain.

Identity theft is the crime of obtaining the personal or financial information of another person for the sole purpose of assuming that persons name or identity to make transactions or purchases. Ad Victim of Identity Theft. To rent apartments or storage units.

The result is a criminal record in the name of the victim who may not learn of the crime until its too late. What is Identity Theft. Once tax identity fraud has been established the IRS Identity Theft Assistance Department will work with you to make sure your taxes are filed correctly and that anything suspicious is investigated and removed from your file.

Using all 3 will keep your identity and data safer. These include the use of phishing emails fake invoices and tax filing. A study conducted by an independent advisory firm found that 167 million people in the US.

In committing criminal identity theft the perpetrator may. There are a lot of ways ones identity can be stolen. The identity thief may use your information to apply for credit file taxes or get medical services.

Noun the illegal use of someone elses personal information such as a Social Security number especially in order to obtain money or credit. Place a free one-year fraud alert on your credit reports by contacting any one of the three nationwide credit reporting companies online or through their toll-free numbers. Basically its identity theft plus tax fraud.

These acts can damage your credit status and cost you time and money to restore your good name. The Federal Trade Commission received over 440000 reports of identity theft in 2018 70000 more than in 2017. Dont Wait to Get ID Theft Protection Start Today.

If you suspect you are a victim of tax identity theft here are some steps to follow. A tax identity theft scam or W-2 scam can happen if say a cybercriminal hacked into an executives email account and sent communication from that alias targeting your HR or payroll department. If your tax related identity theft issue is causing you financial hardship you can contact the Taxpayer Advocate Service at 877 777-4778 for assistance.

Identity theft occurs when someone uses another persons personal identifying information like their name identifying number or credit card number without their permission to commit fraud or other crimesThe term identity theft was coined in 1964. Tax identity theft whether its with the Internal Revenue Service or your state s Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolveThe IRS in partnership with the state tax administrations and the software companies that produce at-home filing software has announced several changes. Examples of business identity theft scams.

Identity ID theft happens when someone steals your personal information to commit fraud. With certain identifying information dishonest individuals can assume the identity of. Criminal identity theft occurs when someone cited or arrested for a crime presents himself as another person by using that persons name and identifying information.

If you do not receive a resolution within a reasonable time frame you can contact the IRS Identity Protection Specialized Unit at 800 908-4490 and request assistance. If your client is a victim of identity theft then you should contact the IRS Identity Protection Specialized Unit IPSU toll free at 800 908-4490. To steal money from existing accounts.

If this happens go to IdentityTheftgov and report it. An identity thief can steal thousands of dollars in a victims name without the. If you choose IdentityTheftgov will submit the IRS Identity Theft Affidavit to the IRS online so that the IRS can begin investigating your case.

Identity theft occurs when someone uses your personal information for their own gain. Tax identity theft is a growing problem and particularly for vulnerable groups.

Identity Theft Definition How To Prevent How To Report

Tax Identity Theft American Family Insurance

Types Of Identity Theft And Fraud Experian

Learn About Identity Theft Chegg Com

Identity Theft Definition What Is Identity Theft Avg

Irs Form 14039 Fill Out Printable Identity Theft Affidavit

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

What Is Identity Theft Definition How It Happens And The Different Types

What Is Identity Theft Definition Types Protection Study Com

What Is Identity Theft Definition How It Happens And The Different Types

Tax Identity Theft American Family Insurance

Learn About Identity Theft And What To Do If You Become A Victim

What Is Identity Theft Definition From Searchsecurity

Understanding Business Identity Theft What Makes It Vulnerable

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)